Breast Reduction Insurance Coverage Guide

Many patients considering breast reduction surgery, or reduction mammaplasty, to treat symptoms such as neck, shoulder, and back pain may believe that referral by another physician guarantees health insurance coverage. However, the reality is that many factors can complicate insurance approval for the procedure. Insurance companies often view breast reduction as a cosmetic procedure unless the patient demonstrates a significant health-related need. Criteria for coverage vary among insurers and may include requirements for physical therapy, chiropractic treatment, or consultations with specialists prior to surgery. To better navigate the complexities of insurance coverage for breast reduction, patients are advised to research their insurance policy’s specific criteria and be prepared for a process that may require extended preparation, including secondary healthcare provider consultations and possible therapy.

Key Takeaways

- Insurance companies often view breast reduction as a cosmetic procedure, making approval for coverage more complex.

- Criteria for coverage vary among insurers and may require additional consultations or treatments to demonstrate a significant health-related need.

- Understanding the specific breast reduction insurance requirements for a given policy is crucial to obtain coverage.

- Patients should document the medical necessity of the surgery, including symptoms and attempted treatments, to help support their case.

- Consulting with primary care physicians, specialists, and the insurance carrier can guide the process towards successful coverage of a breast reduction and insurance.

Understanding the Medical Necessity of Breast Reduction

When considering the breast reduction cost with insurance coverage, it is crucial to understand how insurance companies define medical necessity for this procedure. A breast reduction surgery might be deemed medically necessary if it addresses severe symptoms experienced by the patient, such as persistent pain or discomfort. This section will explore what constitutes medical necessity for insurance companies and the impact of symptomatic macromastia on a patient’s health and quality of life.

What Constitutes Medical Necessity for Insurance Companies

Insurance companies evaluate several factors when determining medical necessity for breast reduction. Contrary to popular belief, it is not solely based on the amount of breast tissue to be removed. Instead, the focus is on the symptoms experienced by the patient and their impact on daily life. Some of the symptoms that may lead to qualifying for insurance coverage for breast reduction include:

- Chronic neck, shoulder, or back pain

- Rashes or fungal infections due to excessive skin folds

- Significant interference with daily activities, such as exercise or sleeping

It is vital for patients seeking insurance coverage for this procedure to provide detailed documentation of their symptoms, their impact on daily activities, and any previous treatments that they have tried without success.

The Impact of Symptomatic Macromastia on Health

Symptomatic macromastia refers to the condition where large, heavy breasts cause physical discomfort or pain in the patient. This condition can significantly impact a person’s health and quality of life. Some of the health issues associated with symptomatic macromastia include:

- Poor posture

- Musculoskeletal pain

- Deep shoulder grooves due to bra strap pressure

- Decreased mobility and functional limitation

- Emotional distress, anxiety, or depression

When considering breast reduction surgery and insurance coverage, it is essential to address the health issues caused by symptomatic macromastia. Detailed documentation of these issues, the treatments used thus far, and their impact on your daily life will play a critical role in influencing the decision of insurance companies. By understanding the medical necessity criteria and compiling a thorough case, patients can improve their chances of obtaining coverage for their breast reduction surgery.

How to Get a Breast Reduction Covered By Insurance

For patients seeking insurance approval for breast reduction and getting insurance to cover breast reduction, it is crucial to understand the process involved. The first step is to contact your insurance carrier and request the criteria for coverage in writing. Due to varying criteria among companies, what might be approved for one individual might not necessarily apply to another.

Patients should start documenting any symptoms related to macromastia early, as this documentation will play a significant role in the insurance approval process. It can be helpful to maintain a health diary detailing symptoms, the impact of these symptoms on daily activities, and any treatments attempted. This information can strengthen the case for insurance coverage by demonstrating the medical necessity of the breast reduction surgery.

Additionally, it is essential to consult with the plastic surgeon’s office, as they may offer guidance throughout the insurance process. Their experience in dealing with insurance companies can be invaluable in navigating the complexities of the approval process.

It is important to contact the insurance carrier and request the criteria for coverage in writing. Patients should start documenting any symptoms related to macromastia early and consult with their plastic surgeon’s office for guidance throughout the insurance process.

Here are some steps to follow in getting insurance approval for breast reduction:

- Contact your insurance carrier and request the written criteria for coverage.

- Document your symptoms related to macromastia and the impact on your daily activities.

- Consult with your plastic surgeon’s office for guidance and support.

- Compile relevant medical documentation and a health diary to support your case for medical necessity.

- Work closely with your plastic surgeon’s office to navigate the insurance approval process.

In conclusion, obtaining insurance coverage for breast reduction surgery may be a complex process, but it is not impossible. By following the above steps and actively advocating for the medical necessity of the procedure, patients can increase their chances of getting their breast reduction surgery covered by insurance.

Initial Steps for Insurance Approval for Breast Reduction

Embarking on the journey of insurance approval for breast reduction involves several crucial steps. Meeting the insurance criteria for breast reduction is essential in demonstrating the medical necessity of the surgery. The process usually begins with consulting your primary care physician and gathering the necessary documentation and medical history.

Consulting with Your Primary Care Physician

Your primary care physician is your first point of contact for evaluating your symptoms associated with macromastia, which may include chronic pain, discomfort, or skin irritation. They will determine whether the symptoms warrant a surgical intervention and may recommend a consultation with a breast reduction specialist. Maintain open communication with your physician to ensure they understand the extent of your issues and provide relevant guidance.

Gathering Documentation and Medical History

Another vital step is the compilation of a comprehensive medical history, which documents your symptoms and treatments related to macromastia. This information will be critical in establishing the medical necessity of breast reduction surgery for insurance providers. Collect any relevant records of previous treatments or consultations, such as chiropractor visits, physical therapy sessions, or dermatologist appointments. Keep a thorough and organized file of your documentation, as it will be indispensable when submitting your case to the insurance company.

Navigating Insurance Criteria for Breast Reduction

Understanding insurance criteria for breast reduction coverage is crucial for patients seeking reimbursement. Knowing how insurance companies assess medical necessity helps patients determine if they meet the eligibility requirements for coverage. One way that insurance providers evaluate the necessity of breast reduction surgery is by using the Schnur Sliding Scale.

Understanding the Schnur Sliding Scale

The Schnur Sliding Scale was developed by a plastic surgeon as a tool to determine the medical need for breast reduction. This scale is widely utilized by insurance companies to assess whether a patient’s breast reduction surgery is necessary for health reasons. The scale takes into account the patient’s body surface area (BSA) and calculates the minimum amount of breast tissue that should be removed to alleviate symptoms and meet insurance coverage criteria.

Comparing Body Surface Area and Required Tissue Removal

When meeting with a breast reduction specialist, they will calculate the patient’s BSA and the recommended amount of tissue to be removed. The specialist can then compare these measurements to their insurance provider’s eligibility requirements, which may be based on the Schnur Sliding Scale. This comparison can help patients better understand if they are likely to receive insurance reimbursement for breast reduction.

| Body Surface Area (BSA) | Minimum Tissue Removal Weight (grams) |

|---|---|

| 1.60 – 1.69 m2 | 300g |

| 1.70 – 1.79 m2 | 350g |

| 1.80 – 1.89 m2 | 400g |

| 1.90 – 1.99 m2 | 450g |

| 2.00 – 2.09 m2 | 500g |

By understanding how insurance criteria and the Schnur Sliding Scale work, patients can be better prepared for the insurance approval process and increase their chances of receiving coverage for their breast reduction surgery.

Insurance Reimbursement for Breast Reduction: The Process

Understanding the insurance reimbursement process for breast reduction helps patients to be better prepared when seeking financial assistance. This process includes several essential steps, which ensure that you make an informed decision in consultation with your insurance provider, and avoid any unexpected costs not covered by your insurance. Let’s delve into the key steps that can contribute to a smoother reimbursement experience.

The first step in the reimbursement process is an assessment conducted by your surgeon. In this evaluation, your surgeon will examine the amount of breast tissue to be removed and determine how the surgery may alleviate health concerns. This thorough analysis allows the surgeon to provide concrete evidence to the insurance company of the potential benefits and medical necessity of the procedure, as it relates to your specific case.

Once the surgeon’s assessment is complete, they will submit a detailed report containing their findings to the insurance company for approval. This process may take some time, as insurers review each case individually. During this period, it is vital to maintain consistent communication with your surgeon and insurance provider to stay up-to-date on the progress of your application.

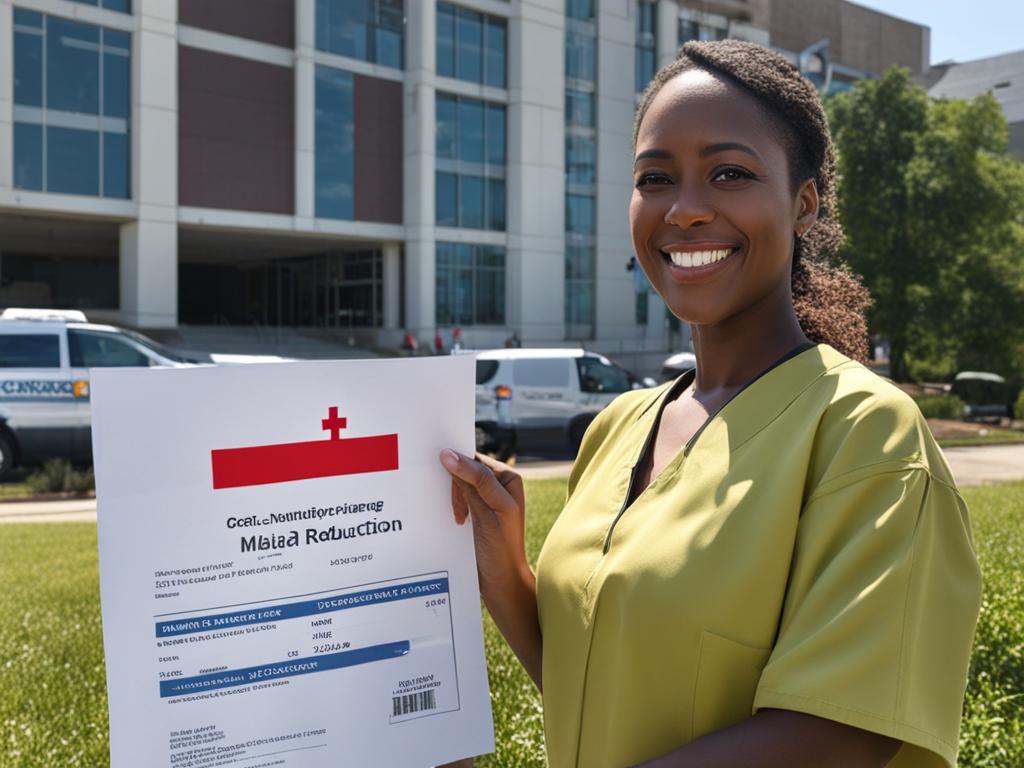

To facilitate the insurance reimbursement process, many specialists offer patients free insurance verification services. These services provide valuable information and support, helping patients understand their insurance coverage and navigate the various requirements and steps necessary for approval. These verification services can also assist in identifying any potential gaps in your insurance policy, ensuring that you are aware of potential out-of-pocket costs.

- Consult your surgeon for an assessment and evaluation of your case

- The surgeon submits their report and findings to your insurance company

- Maintain communication with your surgeon and insurance provider during the approval process

- Consider utilizing free insurance verification services to better understand your coverage

In conclusion, navigating the insurance reimbursement process for breast reduction surgery can be complex, but understanding the essential steps involved can significantly improve your experience. Knowing the breast reduction cost with insurance coverage will allow you to make informed decisions and prepare yourself financially for the procedure.

Breast Reduction and Insurance: Preparing Your Case

When preparing your case for insurance coverage of breast reduction surgery, it is essential to provide comprehensive documentation of the medical necessity, which can help increase the likelihood of approval. This may involve consulting with various healthcare professionals and obtaining letters of medical necessity. Understanding the required documentation can help you navigate the breast reduction insurance requirements and set you on the path toward a successful insurance approval process.

Consulting with a Chiropractor or Physical Therapist

One crucial aspect of preparing your case involves consulting with a chiropractor or physical therapist in addition to a primary care physician. Their evaluations and recommendations can provide valuable insights into the potential benefits of breast reduction surgery for your specific health concerns. Providing documentation from multiple healthcare practitioners can strengthen your case and demonstrate the need for the procedure.

Letters of Medical Necessity and their Importance

As part of meeting breast reduction insurance requirements, obtaining a letter of medical necessity from your plastic surgeon is crucial. This letter should outline the severity of your symptoms, the impact on your daily life, and the expected amount of breast tissue to be removed during surgery. In addition to this letter, it is essential to compile consultation notes, previous treatments pursued, and any other relevant information that validates the medical need for a breast reduction.

The more comprehensive the documentation of your medical necessity, the better your chances of insurance approval for your breast reduction surgery.

As you progress through the process of preparing your insurance case for a breast reduction, it is vital to consult with and gather evaluations from various healthcare professionals, maintain detailed documentation of your symptoms and treatments, and present a solid argument for the medical necessity of the surgery. By understanding the breast reduction insurance requirements and following these guidelines, you can significantly improve your chances of obtaining insurance coverage for your procedure.

Insurance Coverage for Breast Reduction: Knowing Your Policy

Understanding your individual health insurance policy is essential for knowing the terms of coverage for breast reduction surgery. Insurance carriers’ requirements for coverage may vary depending on the individual’s policy, state regulations, and whether they deem the procedure medically necessary. Several factors can contribute to how to get a breast reduction covered by insurance, such as utilizing free insurance verification services and knowing the role of individuals in contrast to state guidelines.

Free Insurance Verification Services

Free insurance verification services can be an invaluable asset for patients trying to determine eligibility and coverage details for breast reduction surgery. These services review your insurance policy and provide a clearer understanding of what breast reduction procedures will be covered by your plan. By taking advantage of these specialized services, patients can save time and effort navigating through complex insurance policies and requirements.

The Role of Individuals vs. State Guidelines

Insurance requirements for breast reduction coverage can be influenced by both individual policy guidelines and state regulations. While some states mandate insurance companies to provide specific coverage levels for breast reduction surgery, others may not have such requirements in place. Therefore, investigating the specific requirements of your insurance policy, as well as being aware of your state’s guidelines, is crucial to ensure your breast reduction surgery is covered by insurance. Always consult with your insurance provider and healthcare professionals to clarify your eligibility and pursue the necessary steps to secure coverage.

Qualifying for Insurance Coverage for Breast Reduction

Obtaining insurance coverage for breast reduction surgery can be an intricate process. Patients must meet specific criteria, and many insurance carriers require comprehensive evaluations from different medical specialists to establish the patient’s eligibility for coverage. In this section, we will discuss the importance of seeking multidisciplinary evaluations and the essential documentation needed to satisfy breast reduction insurance requirements.

Seeking Multi-disciplinary Evaluations

Insurance carriers often need corroborating evidence of the medical necessity for breast reduction surgery. This is where multidisciplinary evaluations come in. They provide detailed assessments from professionals like dermatologists, orthopedists, or other medical specialists relevant to the symptoms experienced by patients.

These evaluations typically cover various aspects of the patient’s condition, including:

- Physical examination findings

- Records of prior treatments such as medications, physical therapy, or chiropractic care

- Narratives of the patient’s symptoms and their impact on daily activities

- Details of any comorbidities that could worsen the patient’s condition if left untreated

Patients should also be prepared to provide documentation of a specific period of treatment. This can vary depending on the individual insurance carrier, but it often ranges from six months to a year. Providing detailed and thorough documentation can help support the patient’s claim for insurance coverage.

Remember: Meeting breast reduction insurance requirements is crucial for achieving coverage and minimizing out-of-pocket costs for the procedure. Work closely with your healthcare team and insurance carrier to ensure all necessary documentation is acquired and submitted in a timely manner.

The Real Cost of Breast Reduction with Insurance Coverage

Getting a breast reduction surgery can be life-changing for many patients, but understanding the associated costs is essential for proper financial planning. Although insurance coverage can help alleviate some of the financial burden, patients should be prepared for possible out-of-pocket expenses. Factors like the specific insurance policy and surgeon’s fees can ultimately influence the final cost of the procedure.

Before proceeding with the surgery, patients must acquire pre-authorization from their insurance providers. This proactive step can confirm the extent of coverage and help patients avoid unexpected expenses. Unfortunately, some costs might still require out-of-pocket payments, including co-pays, deductibles, and additional fees not covered by the insurance.

What to Expect Regarding Out-of-Pocket Expenses

When budgeting for the breast reduction cost with insurance coverage, it is important to consider each aspect of the surgery, from the surgeon’s fee to facility and anesthesia costs. Although some expenses may be covered by insurance, there are other components that might not be eligible for reimbursement.

- Surgeon’s Fee: This fee may be partially or fully covered by insurance, but patients should inquire about their policy to determine the extent of coverage.

- Facility Fees: Depending on the location of the surgery, facility costs might differ and can impact how much the patient pays out-of-pocket.

- Anesthesia: The cost of anesthesia can also vary and may not be completely covered by insurance.

- Additional Expenses: There could be various post-operative costs, such as medications and compression garments, that may not be covered by insurance.

Ultimately, the expenses for a breast reduction surgery, even with insurance coverage, can be hard to predict, so patients should be prepared for unexpected costs. It is crucial to have an open discussion with the plastic surgeon and the insurance provider to ensure that the patient has a comprehensive understanding of the expenses and coverage details.

Avoiding Pitfalls: Breast Reduction Insurance Requirements

Navigating the insurance approval process for breast reduction requires an understanding of insurance requirements. Failure to complete all necessary pre-authorization steps, such as consultations with specialists, and a documented history of treatments, could lead to a denial of coverage. Ensuring that every aspect of the insurance company’s requirements is addressed can help smooth the path to obtaining insurance coverage for the surgery.

Knowledge is power when it comes to breast reduction and insurance.

Below is a table summarizing key aspects that patients need to consider while preparing for insurance approval:

| Aspect | Details | Importance |

|---|---|---|

| Consultations with Specialists | Physician referral, Orthopedic surgeon, Chiropractor, Physical therapist | Provides evidence of medical necessity |

| Documented History of Treatments | Physical therapy, Medications, Use of supportive garments | Shows reasonable conservative measures have been attempted before pursuing surgery |

| Measurement and Reduction Calculation | Schnur Sliding Scale, Body Surface Area (BSA) comparison | Helps determine if the required tissue removal aligns with insurance coverage criteria |

| Letters of Medical Necessity | From specialists stating the rationale for surgery and amount of tissue to be removed | Enhances the argument for medical necessity |

By addressing these aspects thoroughly and effectively, one can increase the likelihood of meeting the breast reduction insurance requirements and obtaining coverage.

Remember to engage with healthcare providers and insurance early in the process. Keep clear and concise communication with all parties involved and ensure proper documentation of symptoms and treatments. By following these steps, patients can confidently pursue breast reduction surgery with financial support from insurance.

Tips on Getting Insurance Approval for Breast Reduction

Obtaining approval for breast reduction surgery can be a complex process involving various steps and factors. To increase the chances of a successful outcome, patients should engage early with their healthcare providers and effectively communicate their symptoms, all while maintaining transparency with their insurance providers.

Early Engagement with Your Health Care Providers

Starting the documentation process early is crucial when it comes to securing insurance approval for breast reduction surgery. By engaging with healthcare providers from the beginning, patients can establish a clear medical necessity for the surgery. This involves compiling a comprehensive case history, which includes symptoms, treatments attempted, and the overall impact these issues have on the patient’s daily life.

Effectively Communicating Your Symptoms

Transparent and consistent communication of symptoms plays an essential role in getting a breast reduction covered by insurance. Patients must document all relevant medical issues and clearly express their health concerns to healthcare providers and insurance carriers. This effective communication can lead to a smoother approval process and play a significant part in obtaining insurance coverage for the surgery.

FAQ

What constitutes medical necessity for insurance companies?

Medical necessity for breast reduction is often linked to symptoms the patient experiences, such as back and neck pain or dermatitis, rather than solely on the amount of breast tissue to be removed. Detailed documentation of symptoms, their impact on daily activities, and previous treatments attempted are crucial for insurance consideration.

How do I get a breast reduction covered by insurance?

For insurance coverage of a breast reduction surgery, it is important to contact your insurance carrier and request the criteria for coverage in writing. Start documenting any symptoms related to macromastia early and consult with your plastic surgeon’s office for guidance throughout the insurance process.

What are the initial steps for insurance approval for breast reduction?

Consult with your primary care physician about any symptoms related to macromastia, and begin gathering a comprehensive medical history and documentation, including any previous treatments or consultations for related symptoms, necessary for demonstrating the medical necessity of the surgery to insurance providers.

How can I understand the insurance criteria for breast reduction?

The Schnur Sliding Scale, often used by insurance companies to assess medical necessity, considers the patient’s body surface area (BSA) and the amount of breast tissue recommended for removal. Meeting with a breast reduction specialist can help you understand if these measurements align with insurance eligibility requirements.

Are there any specific requirements for breast reduction insurance coverage?

Insurance companies may have specific requirements, such as consulting with a chiropractor or physical therapist, as well as a letter of medical necessity from a plastic surgeon specifying the amount of tissue to be removed. Ensuring that every aspect of the insurance company’s requirements is addressed can help smooth the path to obtaining insurance coverage for the surgery.

How can I know my insurance policy’s terms for breast reduction surgery coverage?

Utilizing free insurance verification services offered by some plastic surgeons can be an invaluable asset for patients to determine eligibility and coverage details for breast reduction surgery under their specific insurance policy.

What are some tips on getting insurance approval for breast reduction?

Engage with your healthcare providers early, document all relevant medical issues, establish a clear medical necessity for the surgery, and communicate effectively with insurers throughout the process. Putting together a comprehensive case that includes a history of symptoms, treatments attempted, and impact on daily activities is also essential.