Accidental Fire Caused by Tenant: Liability Tips

The ripple effects of an accidental fire caused by tenant negligence can quickly spiral into a legal and financial maelstrom for landlords and tenants alike. With the stakes high in terms of property damage, financial losses, and emotional turmoil, understanding liability and proactive measures is paramount. In the United States, the National Fire Prevention Association has highlighted the grim reality of fires leading to billions in losses, thus underscoring the critical need for both landlords and tenants to grasp the responsibilities and protections involved in such unfortunate events.

Whether a searing pan left unattended or an errant cigarette igniting furniture, the causes of such fires are as diverse as the consequences are severe. Landlords may face extensive repair costs and lost rental income, while tenants could deal with the stress of displacement and loss of personal belongings. Thus, navigating the aftermath of a tenant negligence fire requires a solid understanding of the intertwined responsibilities and the sufficiency of coverage provided by insurance policies.

Often, the line between accident and negligence is thin but consequential. A tenant responsibility fire accident not only necessitates financial compensation but also a measure of emotional sensitivity, with landlords and tenants needing to work in tandem to resolve the issues. As they sift through the debris of a fire incident, it’s not just about what’s burnt—it’s about what steps to take next, by whom, and how promptly and effectively these steps can be implemented.

Key Takeaways

- Identifying factors that determine a tenant’s liability in the case of an accidental fire.

- Grasping the financial implications for both tenant and landlord following a fire.

- Understanding how insurance coverage responds to accidental fires in a rental property.

- The importance of clear communication and legal understanding in the wake of a fire incident.

- Implementing proactive strategies for landlords to mitigate risks and educate tenants.

- Key responsibilities of landlords and tenants in documenting and recovering from fire damage.

Understanding Tenant-Caused Fire Accidents and Their Impact

The risk of fire accident caused by tenant is a reality that property owners and residents must acknowledge. Such incidents not only inflict structural damage but also trigger a cascade of financial and emotional consequences.

The Reality of Fire Incidents in Rental Properties

Homes and rental spaces are often furnished with love and care, making fire damage tenant liability a harsh blow to landlords and renters alike. Annually, fire accidents in rental properties contribute significantly to the national property damage statistics, cautioning stakeholders about the prevalent dangers posed by negligence or mishaps.

Financial and Emotional Toll on Landlords and Tenants

When rental property fire caused by tenant occurs, it is not only the physical repairs that burden the property owners. Landlords face potential loss of income due to uninhabitable conditions post-incident, while tenants grapple with displacement and loss of personal belongings that transform their lives overnight.

Assessing the Cost: The Numbers Behind Destruction

| Damage Type | Repair Cost | Rental Income Loss | Total Financial Impact |

|---|---|---|---|

| Structural Damage | $50,000 | $6,000 | $56,000 |

| Smoke/Soot Cleanup | $15,000 | $3,000 | $18,000 |

| Personal Property Loss (Tenant) | $25,000 | — | $25,000 |

| Temporary Housing (Tenant) | — | $2,000 | $2,000 |

Such costs reflect the dire need for both preventative measures and adequate insurance coverage to combat the ramifications of fire accident caused by tenant, underscoring the indispensable value of mindful tenancy and robust safety protocols.

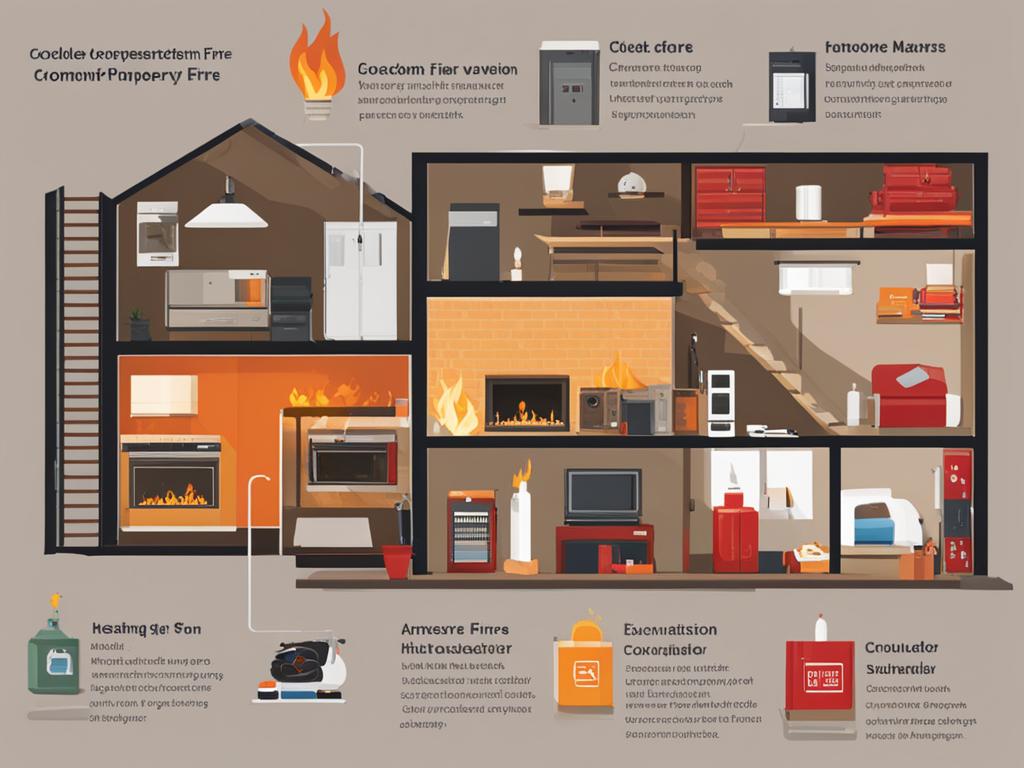

Common Causes of Accidental Fire Caused by Tenant

When exploring the different origins of an accidental fire in a rental property, it’s essential to understand that many incidents are preventable with proper knowledge and precautions. The most typical catalysts involve routine activities that, when mishandled, can turn disastrous.

- Cooking Mishaps: Unattended stoves and ovens are notorious for sparking fires.

- Electrical Malfunction: Overloaded circuits and faulty wiring can lead to danger.

- Improper Smoking Habits: Carelessly discarded cigarettes are a leading cause of fires.

- Heating Equipment: Misuse of space heaters and central heating can cause fires, especially when they’re placed too close to combustible materials.

- Negligence with Open Flames: Candles and fireplaces require constant vigilance to prevent a blaze.

In each case, education and awareness are key in reducing the likelihood of an accidental fire caused by a tenant. Landlords must enforce clear guidelines and conduct regular checks to ensure safety measures are in place and fully understood by all occupants.

| Fire Cause Category | Common Scenarios | Preventive Measures |

|---|---|---|

| Cooking | Leaving kitchen appliances unattended | Implement a kitchen safety protocol; provide fire extinguishers. |

| Electrical | Using damaged cords or overloading outlets | Regular electrical inspections; educate tenants on electrical safety. |

| Smoking | Smoking indoors or not properly extinguishing cigarettes | Create designated smoking areas; ensure proper disposal of butts. |

| Heating Equipment | Placing heaters near flammable materials | Heater usage guidelines; provision of safe heating options. |

| Open Flame | Leaving candles or fireplaces unattended | Clear rules about candle use; provide fire guards for fireplaces. |

As part of a comprehensive approach to fire safety, highlighting the significance of renters’ insurance for personal property protection is advisable. By doing so, both landlords and tenants can mitigate the financial impact should an accidental fire occur.

Landlord’s Guide to Insurance Coverage for Tenant Accidents

As a landlord, understanding the intricacies of your insurance policy is pivotal when dealing with tenant insurance fire claims. Not all insurance policies are created equal, and it’s crucial to discern the distinctions between landlord insurance and rental property insurance coverage. Below, we provide a straightforward analysis to help you navigate the terms and coverages of your insurance policy, ensuring you’re adequately prepared for any tenant-related accidents.

Analyzing Your Landlord Insurance Policy

Landlord insurance forms the backbone of your financial protection strategy, mitigating losses from fire claims and other tenant-related damages. It’s vital to review the details of your policy annually or whenever changes occur within your rental properties to confirm that your coverage remains comprehensive and up-to-date. Attention to detail can mean the difference between a swift resolution and drawn-out financial burdens following accidental fires.

Separating Myths from Facts: What’s Covered and What’s Not

Deciphering what your landlord insurance actually covers can prevent misunderstandings when filing a claim. Policies may have limitations and exclusions that need to be noted before mishaps occur. Let’s dispel the myths and focus on the facts with a comparison table outlining typical coverages versus common misconceptions.

| Coverage | Typically Included | Common Myths |

|---|---|---|

| Property Damage | Yes, includes damage to the building and any owned personal property within | Assuming all tenant belongings are covered |

| Smoke and Water Damage | Yes, often covered as part of property damage | Believing that mildew or mold from water damage is automatically included |

| Legal Fees | Yes, in case of lawsuits related to the property | Expecting coverage for all legal disputes, regardless of relevance to property |

| Lost Rental Income | Yes, if property is uninhabitable due to covered damage | Assuming rent is covered for any duration of vacancy |

| Deductibles | Yes, landlord pays an initial amount before coverage starts | Believing the insurance will cover all costs from the first dollar |

| Personal Property of Tenants | No, tenants must have their own renter’s insurance | Assuming landlord’s policy covers tenant’s personal belongings |

Renter’s Insurance: How It Protects Tenants

Renters’ insurance is an invaluable tool for safeguarding tenants from the unexpected, including the devastation that may stem from a fire accident. In the unfortunate event of a fire, which could be a result of anything from a cooking mishap to an electrical fault, renters’ insurance acts as a financial shield for tenants, covering not only their personal belongings but also their accountability for damages incurred.

Landlords strongly recommend that tenants carry a robust renters’ insurance policy to ensure that both parties are protected. Fire incidents notably highlight tenant responsibility in a fire accident; hence, having coverage reduces potential conflict and financial burdens. Here are some critical ways renters’ insurance provides peace of mind for both tenants and landlords:

- Personal Property Protection: Coverage for the tenant’s belongings that may be damaged or destroyed by fire.

- Liability Coverage: Financial protection if the tenant is found liable for causing fire damage to the property or harm to others.

- Additional Living Expenses: Costs for temporary housing and living expenses if the rental unit becomes uninhabitable due to fire.

A core component of managing tenancy risks involves adhering to fire prevention tips for tenants. Renters’ insurance providers may offer discounts for those who implement safety measures, such as smoke alarms and fire extinguishers in their homes. Below is a practical table summarizing the tenant responsibilities and how renters’ insurance addresses them in a fire incident scenario.

| Tenant Responsibility | Coverage by Renters’ Insurance |

|---|---|

| Damage to Personal Belongings | Costs covered up to the policy limit |

| Liability for Property Damage | Legal fees and damage reimbursements |

| Temporary Relocation | Expenses for temporary housing and meals |

| Medical Expenses for Injured Parties | Coverage for claims made by guests who are injured |

By encouraging the acquisition and maintenance of renters’ insurance, landlords empower tenants to take proactive measures in safeguarding their residence, thus promoting a stable and secure living environment for all parties involved.

The Legal Aspects of Rental Property Fire Liability

When a fire wreaks havoc on a rental property, thorny legal questions about liability rise from the ashes. The challenge in determining responsibility for fire damages hinges on the fire’s origins and the nature of tenant involvement. Here’s what property owners and tenants need to know about legal liability in cases of rental property fire caused by tenant due to tenant negligence fire.

Understanding Tenant Negligence in Fire Accidents

Tenant negligence is a crucial factor in evaluating liability for fire damage. Should an investigation reveal that a tenant’s irresponsible actions led to the blaze, such as leaving a stove unattended or smoking indoors against lease policies, the tenant may be on the hook for subsequent damage under fire damage tenant liability claims. Establishing negligence often involves assessing the tenant’s adherence to standard safety practices.

Reviewing Your Lease Agreement for Fire-Related Clauses

A lease agreement is more than a document outlining monthly rent and amenities—it’s a crucial legal tool that often includes specific clauses concerning fire-related incidents and the responsibilities of each party. It’s essential for landlords to include detailed terms about tenant negligence fire situations to preemptively address potential disputes over liability and damages.

Landlord vs. Tenant: Determining Who Pays for What

Deciphering the financial fallout from a rental property fire caused by tenant can be complex. While insurance policies may cover certain damages, the lease terms will guide many of the determinations as to who pays for what. Here’s a table that helps illustrate common scenarios and the likely party burdened with costs:

| Scenario | Tenant Liability | Landlord Liability |

|---|---|---|

| Accidental fire caused by tenant neglect | Repair or replacement costs for damaged property | Structural repairs not covered by tenant’s insurance |

| Fire from uncertain origins | Personal property loss potentially covered by renter’s insurance | Building repairs and related costs, unless tenant negligence proven |

| Fire from landlord’s failure to maintain safety standards | Displacement costs, potentially covered by landlord or renter’s insurance | Full repair costs and potential liability for tenant’s property and displacement |

In conclusion, understanding the specifics of fire damage tenant liability is key to navigating the aftermath of a fire incident. Both landlords and tenants must have a clear comprehension of their lease agreements and insurance coverage to effectively address the nuances of liability and recovery.

Immediate Steps to Take After an Accidental Fire in Your Property

Dealing with a fire accident caused by a tenant can be a highly stressful occurrence for both landlords and tenants. Immediate action is not only essential for safety but also crucial for the subsequent recovery process. The following list outlines the steps landlords should undertake promptly after such an event.

- Ensure Safety – Confirm all tenants are safe and account for every individual. Evacuate the property and call 911 if the emergency services are not already on site.

- Secure the Property – Once the property is safely accessible, secure it to prevent further damage or unauthorized access.

- Document the Damage – Create a visual record of the damage with photographs or videos to assist in the insurance claim process.

- Contact Insurance Providers – Notify your insurance company and encourage tenants to do the same with their renters’ insurance.

Providing fire prevention tips for tenants can significantly reduce the risk of fires. However, fires can still occur; therefore, having a documented emergency plan can be incredibly helpful. After ensuring everyone’s safety and securing the property, an immediate concern is to document the extent of the damage and notify all relevant parties.

| Action | Details | Responsible Party |

|---|---|---|

| Evacuation | Ensure the safe and complete evacuation of all residents. Use pre-planned escape routes if available. | Tenant/Landlord |

| Property Security | Prevent unauthorised access and protect property from further elements by boarding up broken windows or damaged doors. | Landlord |

| Damage Documentation | Take date-stamped photos or videos to provide to the insurance company for claim substantiation. | Landlord |

| Insurance Notification | Timely communication with the insurance company is critical in initiating the claim and recovery process. | Landlord & Tenant |

| Damage Assessment | Collaborate with professionals to estimate the damage for accurate repair needs and insurance claims. | Landlord |

Implementing these steps swiftly can help to mitigate the overall impact of the incident and aid in the recovery process. Professional assistance can ensure that landlords fully understand the extent of the damage. The insights gained will allow for a more accurate and efficient claims process, while simultaneously handling any legalities should they arise.

Essential Fire Damage Assessment Practices for Landlords

When faced with the aftermath of a tenant-caused fire, landlords must navigate the complexities of documenting and evaluating property damage. This ensures a solid foundation for pursuing insurance claims and upholding tenant liability where applicable. As property damage can be extensive, understanding the right steps for documenting fire damage and choosing between a professional assessment and a DIY inspection can significantly impact the successful recovery of losses.

How to Accurately Document Fire Damage for Claims

Meticulous documentation is fundamental in establishing fire damage tenant liability and securing rental property insurance coverage. This involves capturing all aspects of property damage through various mediums.

- Take extensive photos and videos from multiple angles to showcase the damage comprehensively.

- Procure an official fire report from the responding fire department to corroborate your claim.

- Maintain a written record of damaged items, dates of purchase, and their estimated value.

These documentation methods serve as incontrovertible evidence of the extent of the damage, facilitating a smoother claims process with insurance providers.

Professional Assessment vs. DIY Inspection: Making the Right Call

Determining the scope of damage wrought by fire can be challenging. Often, hidden damages like electrical issues or structural integrity concerns may not be immediately apparent. Here’s a comprehensive look at Professional Assessment versus DIY Inspection:

| Consideration | Professional Assessment | DIY Inspection |

|---|---|---|

| Expertise | Certified professionals with knowledge of structural and safety standards | Limited to the landlord’s understanding of fire-related damages |

| Comprehensiveness | Extensive, covering latent damages and necessary code compliance | May overlook deep-seated damages or code violations |

| Cost Efficiency | Higher upfront cost, but potentially more insurance compensation due to accurate damage assessment | No initial cost, but potential for reduced insurance payouts due to underestimating damages |

| Insurance Recognition | Reports generally accepted by insurers | May face challenges during the claims process without professional verification |

| Time Efficiency | Assessment is prompt, aiding quicker insurance resolution | Can be time-consuming with risk of delayed claims |

| Peace of Mind | Reliable results that can withstand scrutiny during legal or insurance disputes | Potentially stressful and error-prone, resulting in future disputes |

The decision between a professional assessment and a DIY approach hinges on the landlord’s priorities and resources, but considering the stakes involved with property damage, the former often ensures more accurate and credible results.

Tenant Responsibility in the Aftermath of a Fire

When an accidental fire caused by a tenant occurs, the situation often entails more than just dealing with the immediate damage. Tenants have specific responsibilities they must uphold to ensure a proper resolution to the incident. Understanding the scope of tenant responsibility fire accident is crucial for tenants in navigating the aftermath of such unfortunate events.

Cooperation between the tenant and landlord is essential after a fire. This includes open communication and working together during the fire damage assessment and claims process. It is incumbent upon the tenant to report the event to their renter’s insurance provider promptly to secure coverage for their personal property losses and any related liabilities. In cases of tenant negligence fire, tenants might bear greater responsibility and should be prepared to fulfill their obligations based on their lease agreement and insurance policy.

Additionally, assistive measures may be required on the part of the tenant if relocation is needed. Despite the landlord potentially fronting initial relocation costs, these are usually subject to reimbursement once insurance claims have been resolved. The following table outlines key responsibilities that fall to tenants after a fire event:

| Action Item | Details of Tenant Responsibility |

|---|---|

| Reporting to Insurance | Contact renter’s insurance immediately to file a claim for damages and liability coverage. |

| Documentation of Damage | Assist in documenting damages to personal belongings for renter’s insurance claims. |

| Relocation Coordination | Collaborate with the landlord or insurance agents on temporary relocation logistics if necessary. |

| Lease Agreement Compliance | Adhere to the terms regarding fire damage and responsibilities as outlined in the rental agreement. |

| Repayment of Advances | Ensure repayment for any advances on relocation expenses or other costs covered by the landlord initially. |

Should litigation arise, tenants must also be prepared to participate in legal proceedings to determine the extent of their liability. Amid such challenges, tenants’ adherence to their responsibilities can significantly expedite the recovery and repair efforts following a fire incident.

Collaborating With Insurance After an Accidental Fire Caused by Tenant

Following a fire in a rental property, initiating prompt and precise collaboration with insurance providers is pivotal to help restore normalcy. Navigating through the intricacies of tenant insurance fire claims and landlord insurance policies calls for a concerted effort to achieve financial recovery and property restoration.

Working With Landlord and Renter’s Insurance Companies

Landlords and tenants must work in tandem with their respective insurance companies, exchanging detailed information about the fire to ensure a seamless claims process. For tenants, renters’ insurance will generally cover personal property loss and may even extend to liability for damages to the rental unit. Conversely, landlord insurance focuses on repair costs for property damage and may offset lost rental income.

Streamlining the Claims Process for Faster Recovery

Both landlords and tenants can take steps to speed up the claims process. Timely documentation of damages, immediate reporting to insurers, and following up on claims are crucial. Proper communication channels between all parties enable efficient handling of claims and help hasten the repair and reimbursement procedures.

Creating a detailed inventory of damages is essential. For a landlord, this might include:

- Structural repairs

- Smoke and water damage restoration

- Appliance replacement

- Loss of rental income documentation

For tenants, documenting personal belongings and understanding the coverage scope becomes a priority:

- Clothing

- Electronics

- Furniture

- Additional living expenses if the rental property is uninhabitable

Educating both landlords and tenants on the importance of renters’ insurance and landlord insurance before incidents occur can mitigate confusion and expedite recovery after a fire. Such preemptive measures ensure that when the unexpected happens, the financially disruptive effects of a fire are significantly reduced.

Fire Prevention: Educating Tenants to Avoid Future Disasters

Landlords bear a significant responsibility when it comes to fire prevention within their rental properties. Not only does it involve the integration of fire safety measures, but also requires a commitment to educate tenants on best practices. The reinforcement of these practices can dramatically reduce the likelihood of an accidental fire in rental property, ensuring rental property fire safety and offering essential fire prevention tips for tenants.

Implementing Fire Safety Rules in the Rental Agreement

Instituting a solid foundation for fire safety begins with the rental agreement. Through this document, landlords can establish clear and enforceable guidelines geared toward minimizing fire risks. These rules may include stipulations on the use of space heaters, limitations on smoking areas, and requirements for proper storage of flammable materials.

- Mandatory installation and maintenance of smoke detectors.

- Prohibition of indoor smoking and guidelines for outdoor smoking areas.

- Guidelines on safe use and storage of heating equipment and cooking appliances.

- Instructions for regular cleaning to prevent accumulation of flammable materials.

- A clause mandating tenant compliance with all local fire safety regulations.

Effective Communication and Training Strategies

Frequent communication with tenants is vital in reinforcing the importance of fire safety. This includes providing educational resources, running training sessions, or even sending reminders about testing smoke alarms. Such endeavors aim to maintain a high level of awareness among tenants, which is crucial for the prevention of any potential fire incidents.

| Strategy | Objective | Frequency |

|---|---|---|

| Educational Newsletters | To update tenants on fire prevention and safety tips | Quarterly |

| Fire Drills | Practice evacuation procedures | Bi-annually |

| Safety Equipment Checks | Ensure functional fire extinguishers and smoke alarms | Annually |

Whether through contractual measures or ongoing dialogue, ingraining a culture of fire awareness can create a safer environment for all. As property owners perpetuate these preventative practices, they not only secure their investments but more importantly, safeguard the lives of their tenants.

Conclusion

As we’ve explored, an accidental fire in a rental property is a multi-faceted dilemma that presses landlords into understanding their legal obligations and insurance intricacies. A fundamental grasp of scenarios that lead to a tenant negligence fire and how these can impact both the property owner and the tenant is paramount. By rigorously reviewing insurance policies, inclusive of renter’s insurance, landlords can assure they are adequately equipped to manage the financial implications of such a calamity.

Education on fire prevention and consistent reinforcement of safe practices play a critical role in minimizing the risk of fires. This approach serves as a protective barrier, not just for tenants but also for the investment value of the property itself. Furthermore, clear, transparent communication and collaborative efforts with insurance providers can significantly streamline the recovery process post-disaster, alleviating potential monetary strains.

Ultimately, comprehensive preparedness and proactive measures are the foundation upon which a swift and effective response to accidental fires must be built. Ensuring all parties understand their responsibilities and rights underlines the ability to navigate the challenging waters of fire-related incidents, thus safeguarding assets, relationships, and, most importantly, lives.

FAQ

What constitutes tenant negligence in the case of a fire accident?

Tenant negligence involves actions or inactions by a tenant that fails to adhere to reasonable safety protocols. Examples include leaving cooking unattended, improper disposal of smoking materials, misuse of electrical devices, or any activity that violates clear safety standards resulting in a fire.

What is typically covered under landlord insurance in the event of a tenant-caused fire?

Landlord insurance usually covers the structure of the property against fire damage, loss of rental income while the property is uninhabitable, and may provide liability protection. Landlords should review their policies for specifics as coverage can vary.

Can renters’ insurance provide coverage for damage to the rental property itself?

Renters’ insurance primarily covers tenants’ personal property and may include liability coverage that could assist in paying for damages they are liable for in the rental property. It is not designed to cover structural damage to the property itself.

Who is responsible for fire damage – the landlord or the tenant?

Responsibility for fire damage depends on the cause of the fire. If the tenant’s negligence caused the fire, they could be held responsible. In contrast, the landlord is generally responsible for structural repairs. The terms of the lease agreement and local laws also determine liability.

How should landlords accurately document fire damage for insurance claims?

Landlords should promptly take photos and videos of all damages, obtain and preserve a fire department report, and potentially work with professional assessors who provide a detailed and official estimation of damage for insurance claims and potential legal needs.

What immediate steps should be taken following an accidental fire in a rental property?

Ensure everyone’s safety first, call emergency services, secure the property to prevent further damage, and notify relevant insurance companies. Documentation of the damage and initiating a professional fire damage assessment should follow.

How can a tenant fulfill their responsibilities after a fire?

Tenants should report the incident to their renters’ insurance provider, assist with the investigation and claims process, comply with relocation procedures if required, and follow terms outlined in the lease agreement concerning fire damages.

How do landlords and tenants cooperate with insurance companies after a fire?

Both parties should notify their respective insurance companies immediately, provide accurate information about the incident, and coordinate with adjusters. They should collaborate to ensure a prompt and fair settlement and restoration process.

What fire prevention measures should landlords include in the rental agreement?

Landlords should stipulate fire safety rules, include requirements for renters’ insurance, and outline tenant obligations for maintaining smoke alarms and other fire prevention devices. Educating tenants on emergency procedures and the safe use of appliances is also advisable.

What strategies can landlords use to communicate fire safety and prevent accidents?

Landlords can provide regular fire safety information, arrange for training sessions on the use of fire extinguishers and other safety equipment, enforce a no-smoking policy indoors, and ensure that all heating and electrical systems are properly maintained.